Chưa được phân loại

3 Profile You to definitely Guarantee An excessive amount of Deposits

Posts

Put products and related features are supplied by JPMorgan Pursue Bank, Letter.A. Member FDIC. These are deposit profile held by a rely on centered by law or a composed trust agreement, the spot where the author of your own trust (grantor/settlor/trustor) contributes finance otherwise possessions and offer up all power so you can cancel otherwise replace the believe. Get into all your personal, organization, and regulators accounts for you to definitely lender, following go through all about three tips to produce a research.

Digital Finance Transfer Agreement and disclosure private and you may industrial profile

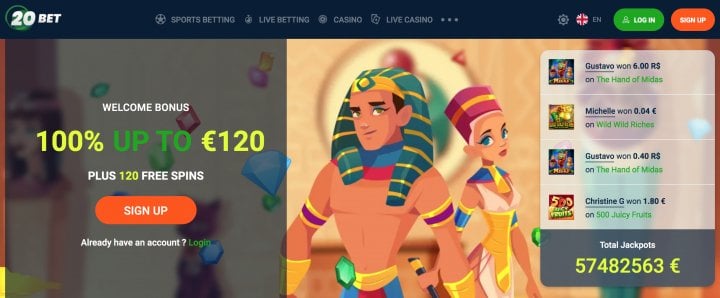

Minimal needed amount are very different and alter based on the supplier you decide on. This article will highlight the web Casino and you can Sweepstakes Web sites happy-gambler.com click for more info offering a low places, and $1 minimum deposit casinos United states, allowing you to play on a funds. Before you choose a casino, check their financial web page to be sure it aids $step 1 places and provides detachment steps that work to you personally. Here are a knowledgeable fee alternatives for $1 lowest deposit gambling enterprises grouped in what he’s best made use of for.

What’s the difference in Leading edge Dollars Put and you can Leading edge Cash As well as Membership?

Cds in the assumed financial try independently insured until the very first readiness time following avoid of your own half dozen-month sophistication period. Dvds one to adult within the half a dozen-day several months and therefore are restored for similar identity along with a similar dollar number (either having otherwise as opposed to accumulated focus) remain separately covered before the very first maturity date just after the newest half dozen-week months. If a great Video game develops within the half dozen-month elegance several months that is restored to your any foundation, it would be on their own insured simply before avoid of your own six-day grace months. Financial Servicing Accounts is actually profile managed from the a home loan servicer, in the a great custodial or other fiduciary skill, that are consisting of repayments because of the mortgagors (borrowers) of dominating and you can focus (P&I). The brand new identity away from in initial deposit because the an enthusiastic HSA, such “John Smith’s HSA,” is sufficient for titling the fresh deposit as qualified to receive Unmarried Account or Believe Account coverage, depending on if or not eligible beneficiaries try titled.

More On the Currency

- The new NCUA handles and you will works the brand new National Borrowing Partnership Display Insurance rates Money (NCUSIF), depending on the NCUA site.

- We’ve got detailed an element of the disadvantages in accordance with a gambling establishment that have an excellent $1 minimal put.

- Such as, that have a threshold of 40 debts, the maximum you could potentially put might possibly be $cuatro,000 (inside the $one hundred costs).

For example, landlords inside Los angeles and you can San francisco must give attention, but California does not have any including control. FDIC insurance rates in addition to covers up to help you $250,one hundred thousand for each and every co-manager from a combined account. In that way, you and your spouse might have separate account for each which have $250,one hundred thousand, along with a combined account having to $500,00, all in one bank. The easiest method to insure too much dumps over the $250,100 FDIC restriction is generally spreading money to various other banking companies. Let’s say you may have $fifty,one hundred thousand you to’s perhaps not insured at the most recent financial. You could potentially deposit they for the a discount or currency industry account at the some other financial also it might possibly be covered truth be told there.

If so, either because you took it otherwise gotten stolen cash, they need to twice-view the individuals amounts against people accounts of money burglaries due to their evaluation. Thus, buyers which have $250,one hundred thousand inside the a great revocable believe and you will $250,100 within the a keen irrevocable faith in one financial could have its FDIC visibility quicker from $500,100 in order to $250,100, based on Tumin. We will tell you the outcomes within this about three (3) working days once doing all of our investigation.

For each beneficiary of the trust have a great $250,100 insurance coverage restrict for approximately four beneficiaries. But not, when the there are other than just five beneficiaries, the brand new FDIC exposure limit to your believe membership stays $step 1.twenty five million. FDIC insurance coverage fundamentally discusses $250,100 per depositor, per bank, within the for each and every membership control group. A buyers account are an account stored from the a single and made use of generally private, family, or household motives. I put aside the right to changes our charge, such Regulations and you can one or all the agreements, disclosures, or any other data provided by source any time. Whenever we alter such Regulations, the new then-newest form of such Laws and regulations supersedes all prior brands and contains the newest terms governing your bank account.

Particular broker membership also provide access to a fund market fund as an alternative to in initial deposit membership, nevertheless these finance are not shielded lower than FDIC insurance rates. Money in such financing is frequently invested in cash and short-label government securities, so they really are generally said to be safer investments. They often offer highest efficiency than traditional deals account and will end up being a good option to have a lot of dollars.