Chưa được phân loại

$5 Deposit gambling enterprise Resident Casino Extra Greatest Low Money Also offers to have 2025

If you are county and you can regional laws are different, really can expect its deposit straight back inside 30 days out of moving away, in addition to a keen itemized set of write-offs. Issuance of Jetty Put and you can Jetty Include renters insurance are subject to underwriting opinion and you will recognition. Please come across a duplicate of your own arrange for the full terms, criteria and exceptions.

If one’s web money out of self-work spent on sometimes area exceed $50,000 for the taxable 12 months, then vogueplay.com additional resources you are susceptible to the new MCTMT. The new $50,100000 threshold try computed for the one basis, even though you file a mutual income tax go back. Deduct range 18 out of range 17 inside for each and every line and get into the results on the web 19. Generally, the new Government count column may be the identical to the newest adjusted gross income claimed on your government return.

- So it cover pertains to MCI grows not obtained but really that have been acknowledged after June 16, 2012.

- It is possible to not receive offers, options to stop charges on the most other goods and services, and/or Dating Rate of interest; to own go out accounts (CDs), which transform will occur in the revival.

- Giovanna and Wi People work with a small loved ones work environment in the Panama permitting people with things of immigration, business formations, and you may financial.

- Although not, the newest registrant remains probably responsible for tax to the fair business property value items unless, during the fresh import from actual fingers of one’s merchandise on the alternative party, the newest registrant receives a fall-delivery certificate in the 3rd party.

- In these cases, you must have fun with one of many most other processing steps revealed inside area.

- You are going to usually come across such generous selling in the no lowest deposit casinos online.

Enter you to area of the government count which you gotten since the a great nonresident away from a business, trade, community, otherwise community continued in the Nyc County. If the company is continued in and from Ny Condition, understand the instructions to possess line six. You might statement the fresh rental earnings inside the Column B as well as in Column C on the internet eleven, as you derived which earnings of Ny State provide through the your own nonresident several months.

Can i sue my possessions management company for withholding my personal defense put?

We do not have access to the newest resident’s account apart from deposit the cash. To own attention to your a balance due for tax season otherwise fiscal several months, the fresh CRA usually imagine only the quantity one to accrued inside ten schedule years until the year the place you create your consult. Such, the consult produced in 2023 have to connect to focus one to accumulated within the 2013 otherwise after. For penalties, the fresh CRA have a tendency to think about your demand on condition that it identifies an income tax season or financial months finish in almost any of your own ten calendar decades before the season the place you make your demand.

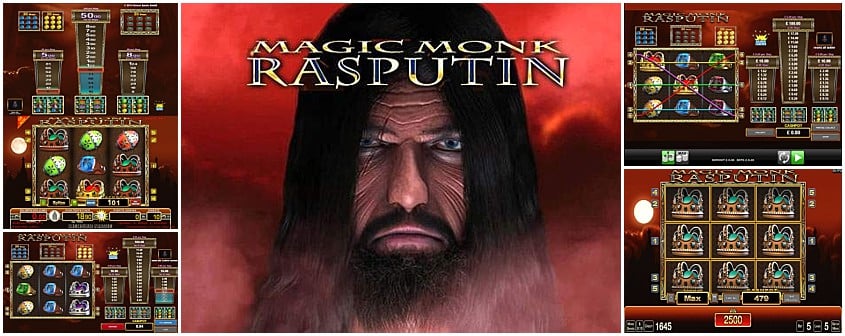

Deposit $5 and also have 80 FS at the Jackpot City Casino

Appropriately, you happen to be a resident to have conversion process taxation motives even though you do not be a resident to own tax motives. If any percentage of it exception are subtracted to the decedent’s personal income tax come back, you ought to earliest slow down the number you are eligible to allege by exact same count subtracted on the decedent’s return. The full pension and you will annuity money exception said from the decedent as well as the decedent’s beneficiaries usually do not meet or exceed $20,one hundred thousand. If you were a part-12 months citizen, include the percentage of all enhancements and you can subtractions one to connect to your brand-new York State resident months from the The new York County amount column. Interac and you can Instadebit is actually one another financial transfer options that will be extremely well-known in the Canada on account of just how simple he is to make use of.

What form to utilize

With this particular supply, a citizen away from Canada shouldn’t have to spend the money for GST/HST to your goods appreciated from the no more than $20 that the resident obtains by the send otherwise from the courier. Seal of approval or any other goods non-owners import briefly for sale in the a tv series or exhibition try subject to the newest GST or the government an element of the HST while they are imported. The newest Canadian part doesn’t charges the brand new GST/HST for the residential billing for the brought in items. The newest arrangement or even the charge should certainly state that the fresh goods were delivered to the fresh Canadian consumer additional Canada. Yet not, in the event the a service is designed to a person who is actually Canada when when the personal have experience of the fresh supplier in terms of the supply, the supply is not no ranked. When you are registered to the GST/HST and supply proof their registration, since the discussed on this page, CBSA will not collect the new GST/HST.

The newest chart, “Assigned and you will elective revealing attacks” that pursue suggests the brand new endurance funds number one to influence the new tasked revealing attacks, plus the elective revealing symptoms readily available when the we would like to file a profit more often. To learn more and you can line-by-range guidelines on how to fill out your own GST/HST come back by using the short method, come across Guide RC4058, Short Type of Bookkeeping to have GST/HST. At the end of for each and every financial seasons, ensure that your company is however entitled to utilize the small means for the coming year.

When you are struggling to receive the Sms verification password otherwise Texting notifications, please try entering a new phone number for Texts announcements. Your own ‘Deposit/Fees History’ is a summary of deals you have made to possess the newest resident. Including dumps to their commissary membership and you can commissary requests. If you have gotten a response out of an earlier registered solution ailment otherwise a proper report on a good CRA decision and be you were not addressed impartially by an excellent CRA personnel,, you could potentially fill in an excellent reprisal criticism because of the filling out Setting RC459, Reprisal Criticism. Non-resident are now able to register their company to have a great CRA organization number and certain system accounts with the Non resident Organization Matter and you may Membership Membership Internet Setting. To find out more go to How to register for a corporate matter or Canada Funds Company program membership.

Inside the 2022, a very important change to the needs to own obtaining house inside the Paraguay are introduced. The foremost is it is no more wanted to establish one’s financial solvency, and that before must be exhibited through a deposit from $5,000 inside a bank. At the conclusion of the procedure, the new placed money was reclaimed, and one perform gain the legal right to permanent residency from the country. Most borrowing from the bank unions one you can now subscribe do offer on the internet and mobile financial characteristics.

Reimburse alternatives

If you don’t understand your future target, provide them with a trusted temporary emailing target. Definitely file just how and when your shared your own emailing address together with your earlier property owner. To determine the number of government earnings related to the choices that must definitely be included in New york supply income, you will want to manage facts and records of the services did inside the New york County.