Chưa được phân loại

Your own Insured Dumps

Blogs

- Alternative inspections along with your rights

- Examine greatest Computer game prices today by term

- Speed background to own Very first National Lender from America’s Cd accounts

- Pulsz Local casino – Score Totally free SCs to have $4.99

- Much more internet casino info

- Why does the newest payment fund works?

You might, including, open a great $250,100000 Video game during the an internet financial giving an aggressive rate for a single-seasons name, plus one $250,100000 Cd during the a different bank with a-two-year term. Common on the web banking companies for example Ally and you can Marcus by Goldman Sachs normally provide aggressive costs next to full FDIC visibility. You might establish a believe and you will term beneficiaries whom perform have the money abreast of your death if you have high an excessive amount of dumps.

Alternative inspections along with your rights

Be sure to browse the Real Award incentive password page for the most recent now offers. You will get a lump sum payment away from 100 percent free coins (usually named Gold coins) after you register. The new https://happy-gambler.com/baywatch/ FDIC are proud getting an excellent pre-eminent supply of You.S. financial industry research to have analysts, and quarterly banking profiles, doing work documents, and you can state banking performance study. The newest FDIC provides extensive info to own bankers, along with tips on legislation, details about assessments, laws and regulations expertise, and you will knowledge applications. They’re also here to be sure your financial security, your money is your, one a great $ten,000 deal try genuine, and that zero con is happening — above all, a fraudulent interest you might be unacquainted with.

Examine greatest Computer game prices today by term

If you’d like the flexibility of withdrawing very early instead a punishment, imagine a zero-penalty Computer game. cuatro.00%Annual Fee Yield (APY) will get transform any moment and you can charge will get lose money. It is value listing you to definitely investment points — along with shared fund, annuities, holds, and you may ties — are not covered by FDIC insurance policies. No-fee Overdraft Exposure as much as $50 to have SoFi professionals which have $1,000 or even more altogether monthly head deposits. This means money your transfer to the mobile banking software isn’t stored on the company one founded the newest application, however with the financial institution they people which have to handle the brand new tech regions of currency government — also to keep your money secure.

Speed background to own Very first National Lender from America’s Cd accounts

The brand new FDIC will not insure stocks, ties, common fund, life insurance, annuities or municipal bonds, even although you make them at the an FDIC-insured financial. The fresh banking and you will DraftKings detachment alternatives can differ according to your own venue, thus read the steps on the state. One other reason the reason we highly recommend DraftKings, even although you have to create a minimum of $5 as opposed to $step one, is simply because you can purchase the new greeting incentive with only $5 put! Needless to say, you can add more money so you can beef up the benefit cash package if you want, nevertheless don’t instantly have to add $20 while the the absolute minimum to obtain the incentive. When you are public casinos render a number of the same games because the genuine currency casinos, discovering the fresh fine print of one’s $step one plan is important.

- Let’s say the car insurance policy features a property wreck accountability limit from $10,100000.

- Such as, home financing servicer gathers from,100 various other consumers their monthly home loan repayments away from $2,one hundred thousand (P&I) and you may towns the cash to your home financing repair account.

- Of a lot gambling enterprises take on elizabeth-wallets, making them a high choice for difficulty-free-banking.

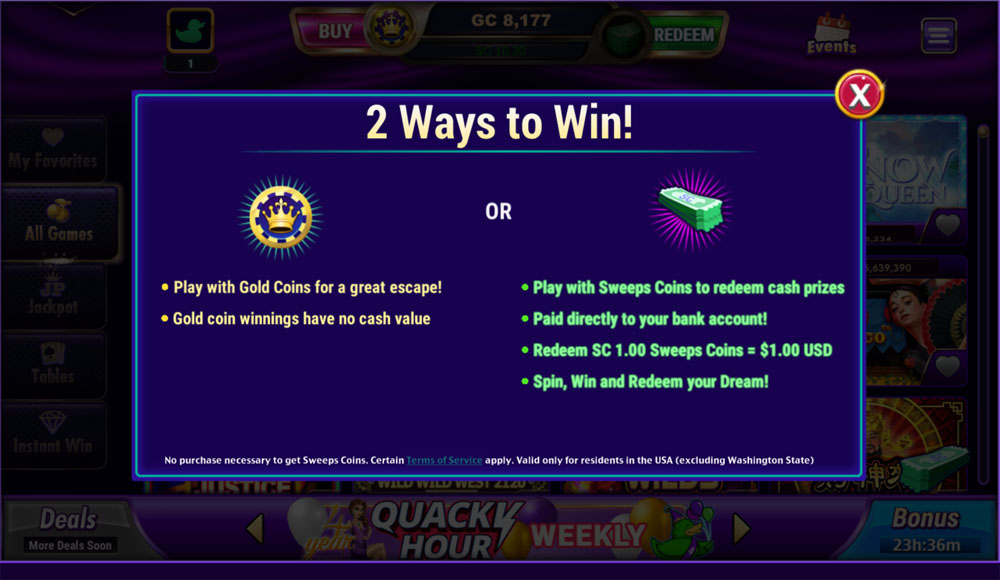

Pulsz Local casino – Score Totally free SCs to have $4.99

You’ll have to visit some other lender, thrift organization or credit partnership, and you also’ll end up being safe. Because the FDIC doesn’t protection credit unions, the Federal Credit Union Management (NCUA) now offers similar defenses. The insurance coverage restrict is applicable only to the accounts in the an individual depository establishment, which means your restrict resets at each financial. Merely don’t go to some other branch of the same bank – that’s perhaps not another business. Dollars government account that have an excellent brush element allow it to be deposits to help you be spread across the multiple FDIC-covered banks.

Bankrate studies more than 100 banking institutions and you will borrowing from the bank unions, as well as some of the biggest loan providers, online-just banks, local banking companies and you may credit unions with one another unlock and you can restrictive subscription regulations. Marcus by the Goldman Sachs offers Video game words anywhere between half a year to half dozen many years, and the lowest necessary opening deposit away from $500 is gloomier than what various other financial institutions charges. And fundamental Cds, the internet-just bank offers no-punishment Dvds and a hit-speed Cd. Marcus’ Cd penalties are to your lower end, compared with those individuals during the contending banks. Another membership can be obtained at the most banking institutions and you will borrowing from the bank unions. They have been federally insured for $250,100 and gives a comfort zone to put your money if you are earning desire.

Much more internet casino info

Proving awareness and you will venture happens a considerable ways inside guaranteeing transparency. Composing a good $10,000 take a look at so you can oneself (or obtaining one from other people) observe a comparable process while the bucks, albeit a tad bit more inconveniently. It’s not simply large dumps more than $ten,100000 prepared to the smaller amounts one number. It’s a challenge which can generate you to $10,one hundred thousand deposit seem like simple cents. Not just does it implicate her or him in the you can unlawful pastime, but structuring is actually unlawful; it informs the us government which you’re also obtaining as much as and you may avert its revealing laws. As well, you can also speak about whether or not you can find any distinctions if you put the same amount in the form of a.

People with whom you share membership will simply have the ability to look at account that are distributed to your, maybe not your personal account. Monitors demonstrated non-prescription for fee because of the a non-customer. You or any one of the signers on your membership could possibly get request us to stop fee to the a check composed on your own account by giving us to your membership matter plus the view amount otherwise take a look at assortment. You understand you to definitely except if you will find done and you will direct guidance out of your, we could possibly be unable to choose the fresh seek out and therefore a prevent payment has been asked that may make the look at getting paid off.

Why does the newest payment fund works?

Simultaneously, there aren’t any constraints about how precisely tend to you might transfer money. Think about, always make sure your lender’s FDIC subscription position and you can track your own total deposits at every financial across all your membership. Bringing tips to guard their a lot of places will bring reassurance and ensures your money remains secure, no matter how happens to the bank. You aren’t over $250,100000 within the deposits at the an FDIC-covered financial should make sure their money is federally covered.

Not merely perform the current impressive to the latest features, but also tend to be some of the higher RTP proportions, and this assures fair betting. Gold Coin packages from the sweepstakes gambling enterprises don’t normally have wagering standards. You will need to display some information that is personal — name, day out of birth, and emailing target — to arrange your bank account.